Investment & Business

Latest Post

Understanding The Differences Between Mutual funds vs Unit trust

Mutual funds and unit trusts are both popular investment vehicles that allow individuals to pool their money together and invest in a diversified portfolio of securities. While they have many

How To Avoid 20% Down Payment On Investment Property

Investing in real estate can be a lucrative venture, but the traditional 20% down payment requirement for investment properties can be a significant barrier for many aspiring investors. However, there

What Is The Difference Between Lease And Finance?

Leasing and financing are two common methods of acquiring a vehicle or other assets. While both options allow you to use the asset, there are key differences in terms of

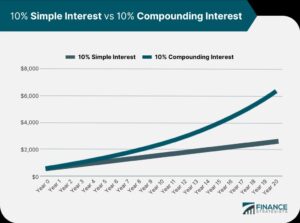

The Power of Compound Interest Accounts: Building Wealth Smartly

Understanding Compound Interest Accounts What is Compound Interest? Compound interest is a powerful financial concept that allows your money to grow exponentially over time. Unlike simple interest, which is calculated

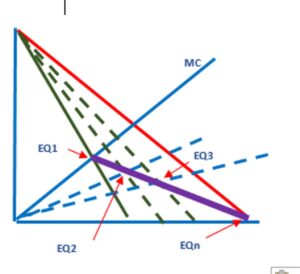

Understanding Nash Equilibrium in Financial Decision-Making

What is Nash Equilibrium? Definition of Nash Equilibrium Nash Equilibrium is a concept in game theory that represents a stable state in which no player has an incentive to change

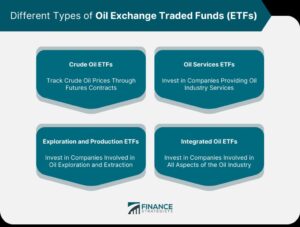

Exploring ETFs: What They Are and How They Work

What are ETFs? Definition of ETFs An Exchange-Traded Fund (ETF) is a type of investment fund and exchange-traded product, with shares that are tradeable on a stock exchange. ETFs are

Interest Coverage Ratio Demystified: Ensuring Financial Stability

Understanding Interest Coverage Ratio Definition of Interest Coverage Ratio The interest coverage ratio is a financial metric that measures a company’s ability to pay its interest expenses with its operating

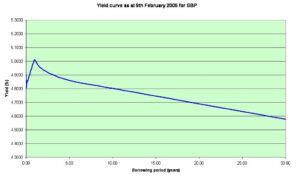

Navigating the Inverted Yield Curve: Implications and Strategies

Understanding the Inverted Yield Curve Definition of the Inverted Yield Curve The inverted yield curve is a phenomenon in which short-term interest rates are higher than long-term interest rates. This

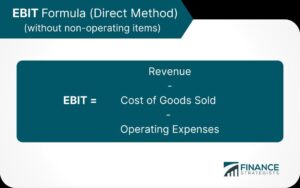

Exploring EBITDA Margin: A Key Indicator for Profitability

Understanding EBITDA Margin What is EBITDA Margin? EBITDA Margin is a financial performance indicator that measures a company’s profitability before accounting for interest, taxes, depreciation, and amortization. It represents the

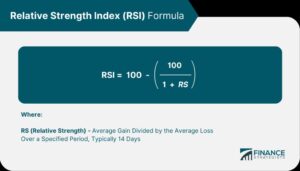

What Is Relative Strength Index (RSI): Gauging Overbought and Oversold Conditions

Understanding Relative Strength Index (RSI) Definition of Relative Strength Index (RSI) The Relative Strength Index (RSI) is a technical indicator used in financial markets to measure the strength and momentum

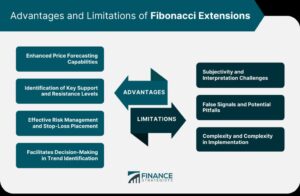

Fibonacci Retracement: Uncovering Potential Reversal Levels

Understanding Fibonacci Retracement What is Fibonacci Retracement? Fibonacci Retracement is a technical analysis tool used in trading to identify potential reversal levels. It is based on the Fibonacci sequence, a

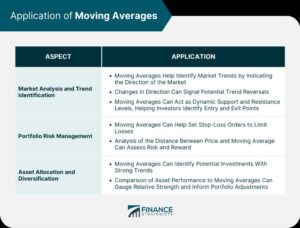

What Are Moving Averages: Riding the Trend Waves

Understanding Moving Averages What is a Moving Average? A moving average is a widely used technical analysis tool that helps smooth out price data and identify trends over a specified

Discover