Terms

Latest post

Demystifying Subrogation: What It Means in Financial Terms

Understanding Subrogation Definition of Subrogation Subrogation is a legal concept that allows an insurance company to step into the shoes of the insured and pursue a claim against a third

Unveiling the Mystery of Retained Earnings in Personal Finance

Understanding Retained Earnings Definition of Retained Earnings Retained earnings refer to the portion of a company’s net income that is kept within the business rather than distributed to shareholders as

Unlocking Year-over-Year (YoY) Trends in Personal Finance

Understanding Year-over-Year (YoY) Trends Definition of Year-over-Year (YoY) Trends Year-over-Year (YoY) trends refer to the analysis of financial data over a period of one year, comparing it to the same

Understanding Summa Cum Laude and Magna Cum Laude: A Comprehensive Guide

What is Summa Cum Laude? Definition of Summa Cum Laude Summa Cum Laude is a Latin term that translates to ‘with highest praise’ or ‘with highest honors’. It is an

Optimizing Your Finances with Inventory Turnover Ratios

Understanding Inventory Turnover Ratios What is an Inventory Turnover Ratio? An inventory turnover ratio is a financial metric that measures the number of times a company sells and replaces its

Demystifying FOB Meaning: Crucial Insights for Financial Literacy

Understanding FOB Meaning Definition of FOB FOB, which stands for Free On Board, is an international trade term that indicates the point at which the seller’s responsibility for the goods

Expansionary vs. Contractionary Monetary Policy: A Comprehensive Comparison

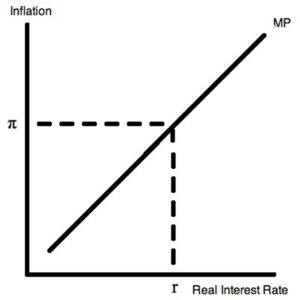

Expansionary Monetary Policy Definition of Expansionary Monetary Policy Expansionary monetary policy is a strategy employed by central banks to stimulate economic growth and increase aggregate demand. It involves increasing the

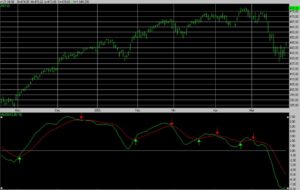

Moving Average Convergence Divergence (MACD): Trend Confirmation and Divergence

What is Moving Average Convergence Divergence (MACD)? Definition of MACD The Moving Average Convergence Divergence (MACD) is a popular technical indicator used in financial analysis. It is designed to reveal

Fixed Unit Investment Trusts: Terms You Need to Know

What are Fixed Unit Investment Trusts? Definition of Fixed Unit Investment Trusts Fixed Unit Investment Trusts (UITs) are a type of investment vehicle that offer investors a fixed portfolio of

ETF Expense Ratios: What They Mean for Your Investment

Understanding ETF Expense Ratios What are ETFs? Exchange-traded funds (ETFs) are investment funds that are traded on stock exchanges, similar to individual stocks. They provide investors with the opportunity to

Bollinger Bands: Volatility and Price Levels

What are Bollinger Bands? Definition of Bollinger Bands Bollinger Bands are a technical analysis tool that consists of a middle band, an upper band, and a lower band. The middle

Open Market Purchases And Interest Rates Unraveling The Connection

Open market purchases, also known as open market operations, refer to the buying of government securities by the central bank, which in the United States is the Federal Reserve. These

Discover

How Long Does It Take To Ship From China To USA

Shipping products from China to the USA is a common practice for many businesses. However, the shipping time can vary depending on several factors. In

What Does CPN Mean In Finance

CPN, which stands for [insert definition here], is a financial acronym that plays a crucial role in investment analysis. Understanding CPN and how to calculate

Equity Excitement Unraveling The World Of Equity Investments

Welcome to the world of equity investments where opportunities for growth and returns are abundant. If you, like many others, are looking to increase your

Wealth Wisdom Essential Insights Into Investment Management

Are you ready to take control of your financial future? If so, then “Wealth Wisdom: Essential Insights into Investment Management” is the perfect article for

No Money Down Secrets To Buying Investment Property Without Cash

Are you tired of feeling like you’ll never be able to afford investment property? Are you worried about not having enough cash to make a